Successful portfolio management depends on timely, accurate insights—from market trends to regulatory updates. To achieve this, firms today must cope up with an overwhelming volume of unstructured data: news articles, SEC filings, corporate websites, transaction records, and social signals.

This massive scale of information presents the core challenge of modern finance. Traditional financial data extraction approaches—manual research, batch processing, or single-source feeds—simply can’t match the speed and breadth required for modern portfolio management.

This is why AI-powered financial data extraction is essential. It solves the scalability problem by creating automated pipelines that continuously monitor, extract, and structure market intelligence from diverse web sources. Let’s dive into the underlying architecture.

Key Takeaways for Investment Professionals

- AI-based data extraction systems is the best way to transform vast, unstructured web data into instant, actionable investment signals for your firm.

- When designing your data extraction system, focus on three pillars: infrastructure capabilities, data quality, and integration readiness.

- This guide provides a technical blueprint to help decision-makers evaluate and select best-in-class AI-driven financial data solutions.

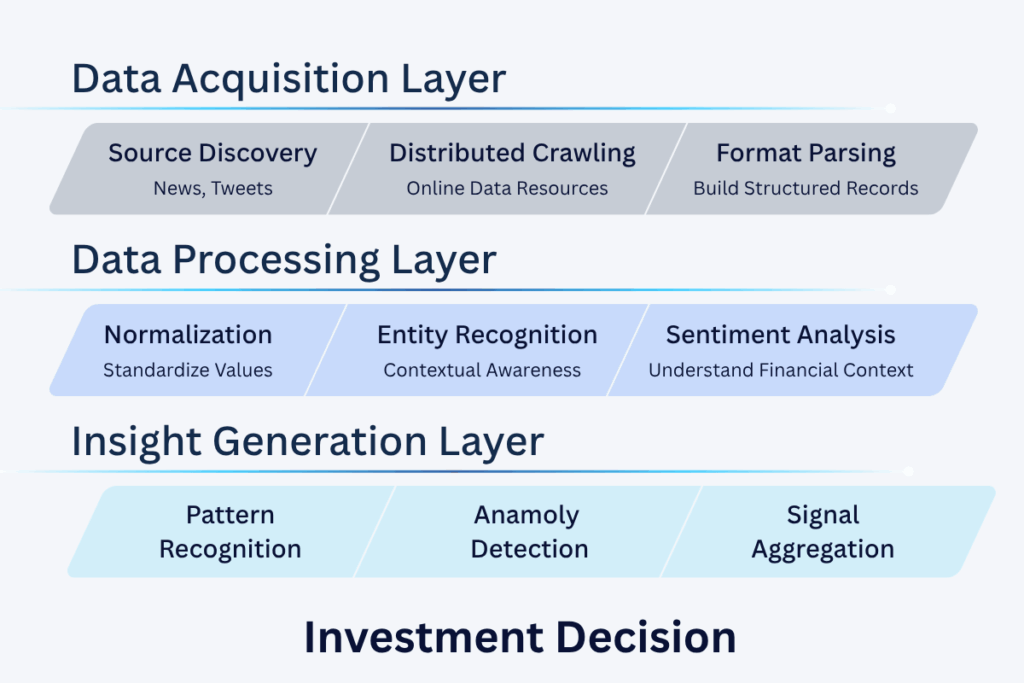

The Data Processing Pipeline: From Raw Web Data to Investment Insights

A robust AI data extraction system follows a three-stage pipeline. Each stage ensures that raw web data is transformed into actionable insights with accuracy, scalability, and compliance.

Stage 1: Data Acquisition

Source Monitoring and Extraction

Capturing accurate financial data requires monitoring thousands of structured and unstructured sources in real time. To achieve this, advanced systems use:

- Distributed crawling architecture to continuously monitor thousands of financial sources (SEC filings, news, corporate sites, alternative data).

- Headless browser automation to capture JavaScript-rendered pages and dynamic financial disclosures.

- API integration for structured sources that offer programmatic access to filings, transactions, or market data.

- Intelligent rate limiting and geographic proxy routing to bypass anti-scraping measures while ensuring compliance with an uninterrupted data flow.

Format Parsing

Once data is collected from multiple financial sources, the next challenge is transforming heterogeneous formats into structured, usable records. This is where format parsing comes in:

- PDF and image parsing with OCR and AI models to extract text from financial statements, invoices, and contracts.

- HTML and XML parsing to capture structured data from regulatory filings and corporate disclosures.

- CSV, Excel, and JSON parsing to normalize transactional and market datasets.

- Adaptive schema mapping to unify inconsistent formats into a standardized financial data model.

Stage 2: Data Processing

Once acquisition is complete, the process moves to transforming and refining this raw, often messy, input. After parsing raw inputs, financial data must be cleaned, normalized, and enriched to ensure accuracy, consistency, and audit readiness. Effective data processing includes:

Normalization Pipeline

To make diverse financial data comparable and analysis-ready, normalization pipelines standardize values across currencies, formats, and entities:

- Currency conversion with historical exchange rates.

- Date/time standardization across global formats.

- Numerical normalization handling various notation systems.

- Company name disambiguation and duplicate detection.

Entity Recognition and Enrichment

Once normalized, financial text must be enriched with contextual intelligence by identifying key entities and their relationships:

- Named Entity Recognition (NER) identifying companies, executives, products, locations

- Relationship mapping connecting entities through transactions and partnerships

- Transformer models like BERT and RoBERTa are fine-tuned using financial texts

- Multi-dimensional sentiment scoring capturing bullish/bearish signals and urgency

Stage 3: Insight Generation

With clean, enriched data points, the system is finally ready to translate them into actionable market intelligence. After entities are recognized and enriched, the next stage is transforming raw data into actionable market signals that support portfolio decisions.

Market signal generation

After entities are recognized and enriched, the next stage is transforming raw data into actionable market signals that support portfolio decisions.

- Time-series correlation analysis identifying leading indicators.

- Cross-asset pattern recognition linking alternative data to traditional metrics.

- Anomaly detection flagging unusual patterns (isolation forests, autoencoders).

- Multi-factor modeling combining dozens of data streams.

- Confidence scoring based on source reliability and historical accuracy.

Pipeline Architecture:

AI Powered Data Flow for Investment Intelligence

Key AI Technologies Transforming Financial Data Extraction

While the three-stage pipeline maps the journey from raw data to insights, the real engine is the set of AI technologies powering each step. Understanding each technology in the stack helps you access higher-quality financial data, ensures completeness across sources, and supports more accurate analysis for portfolio and audit decisions.

- Natural Language Processing (NLP): Advanced NLP models are trained on financial documents to extract key insights from earnings calls, regulatory filings, analyst commentary, and financial news. This enables teams to make faster, more informed decisions and enhances the accuracy and completeness of financial analysis. Multi-source analysis includes scraping forums, global media, and proprietary databases to identify early market signals before broad consensus emerges.

- Real-Time Data Stream Processing: Stream processing enables live scraping of exchanges, news, and global data, supporting high-frequency and event-driven trading strategies.

- Pattern Recognition & Predictive Analytics: Machine learning algorithms are used to spot correlations and trends in data that were previously undetectable, flagging opportunities, risks, and alpha candidates for portfolio managers.

- Computer Vision & Multi-Modal AI: Image, table, and document extraction is enhanced by computer vision, enabling AI to process scans, PDFs, and visual embedded data, especially in private market contexts.

- Human-in-the-Loop Validation: Leading platforms train and blend AI extraction with domain expert review, ensuring critical performance metrics and sensitive financial data maintain accuracy and trust.

Of course, knowing the technology stack is only part of the equation. Successful adoption depends on how these systems are deployed and integrated into existing financial infrastructure. Here’s a roadmap for effective implementation.

Implementation Strategies for Financial Services: A Technical Roadmap

Pre-Implementation Technical Assessment

- Internal Infrastructure Audit: Evaluate existing systems for integration readiness, including data lakes, network architecture, authentication, and current data flows.

- Team Capability Assessment: Determine internal technical requirements, assessing engineering resources, data science expertise for signal development, and IT security for compliance review processes.

Phased Deployment Approach

| Phase | Duration | Scope / Activities | Success Criteria |

| Phase 1: Proof of Concept | 4–6 weeks | – Select 2–3 high-value use cases with clear success metrics- Implement sandbox integration with test data- Validate data quality, latency, and accuracy claims- Assess team learning curve and documentation quality | – High accuracy on test cases- Low query latency- Positive team feedback |

| Phase 2: Pilot Production | 2–3 months | – Implement full integration with one system (portfolio management or risk)- Process live data with human oversight- Monitor performance metrics and edge cases- Establish operational runbooks and alert procedures | – Minimal critical incidents- Achieving SLA targets- Documented business impact |

| Phase 3: Full Production Scaling | 3–6 months | – Expand to additional systems and use cases- Implement automated monitoring and alerting- Train additional teams and stakeholders- Optimize based on production learnings | – Seamless organization-wide deployment- Reliable system performance- Optimized operations based on production feedback |

Bringing these threads together—pipeline design, AI technologies, deployment strategies, and optimization—the key takeaway remains clear: The technical depth of your AI-powered financial data extraction system directly impacts your project performance.

The next question is: which vendors can deliver on these requirements with proven infrastructure and transparency?

Firms that carefully assess vendors based on their infrastructure skills, not just marketing claims, gain a competitive edge. They achieve this by using proper technical planning and gaining better market intelligence.

Forage AI provides enterprise-grade financial data extraction with complete transparency into our technical architecture, real-time processing pipelines, and proven accuracy metrics. Our platform is built for technical teams who demand robust infrastructure, comprehensive APIs, and measurable performance.

Ready to evaluate our technical capabilities? Request detailed architecture documentation and a technical POC to validate our system against your requirements. For technical decision-makers, this guide represents the minimum standard for evaluating financial data extraction vendors. Demand specifics, test claims, and prioritize proven technical capabilities over aspirational features.